US Portfolio

【投资方向】US Stocks (Pharmaceutical, Tech) - focus on capital gain. SG Stocks (Banking, Reits) - focus on creating positive cash flow/ dividends 【投资原则】不投机,逆向思考,做功课 【专注于】Profitability, Growth, Stability 【Mid term Goal】 $1 Million Portfolio

Wednesday, December 2, 2020

Portfolio Nov 20

Saturday, October 24, 2020

Capital Allocation - Oct 20 vs May 20

Overall

Share investment (25% and CPF (25%) have replaced Warchest (20%) as main category in term of capital allocation.

This is align with plan to increase investment (dividend income) & long-term savings (CPF) which earn higher income vs existing HDB bank loan 1.8%.

Shares 25% (vs 16% in May 20)

Monday, October 12, 2020

Portfolio Sept'20

US Portfolio

Saturday, August 15, 2020

Transaction & Portfolio Aug 20

Aug 20 Transactions

I have added all 3 local bank stocks when price went down due to MAS calls on Singapore Banks to cap dividends.

- DBS 500 @ $19.48

- UOB 500 @ $19.05

Monday, July 27, 2020

Portfolio Update Jul 20

Thursday, July 23, 2020

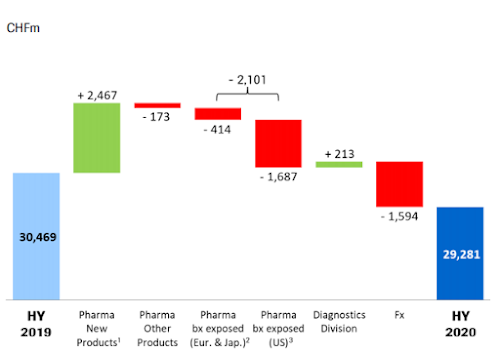

Pharma - Roche Q2'20 Earning

* CER = Constant Exchange Rate

Wednesday, July 22, 2020

Pharma - Novartis Q2'20 Earning

Friday, July 17, 2020

Pharma - J&J Q2'20 Earning

Year to date, immunology growth is 7.9% worldwide and US growth is 5.1%.

STELARA growth of about 10% was driven by continued share gains in Crohn's disease with about a seven-point share increase in the US and growth from the recently approved ulcerative colitis indication.

On a year-to-date basis, STELARA growth remains strong at about 20% globally.

TREMFYA, the first-in-class market-leading IL-23 inhibitor therapy, grew 46% globally and achieved roughly a 10% share of the psoriasis market in the US, which is up about three points from the second quarter of 2019. Sales growth was partially offset by continued erosion of REMICADE of about 14% from share loss due to alternative mechanisms of action and biosimilars.

Monday, July 13, 2020

Net Worth Growth - from Zero to Million

Saturday, June 27, 2020

Capital Allocation Jun 20

Monday, June 22, 2020

Cost Saving from HDB Resales

Sunday, June 21, 2020

Sold My 1st HDB At Loss & Lessons Learned

Thursday, June 18, 2020

2020 Mid Year Portfolio Update

Monday, June 15, 2020

Incomplete Financial Highlights - Pharmaceutical Co. AbbVie

Monday, June 1, 2020

21 Years FIRE Projection - Achievements, Goals and Financial Freedom (Magic need time)

How I maximise cash flow from BTO purchase - HDB loan & bank loan

Sunday, May 24, 2020

DBS 2019 & Q1 2020

OCBC 2019 & Q1 2020

Saturday, May 23, 2020

Capital Allocation - May 20

Friday, May 22, 2020

Warchest & Emergency Funds

Thursday, May 21, 2020

Capital Allocation

In my view, capital allocation is equally important for an individual.

Capital allocation allows me to think how should I allocate my wealth to different assets, ie stocks, FD, properties and bonds, with the objectives to create stable cash flows and maintain reasonable investment return.

My current capital allocation ratio (high level):

Stocks ~20%, average dividend return 3%

Cash/ War Chest ~40%, average interest return 1%

Property ~15%, NIL (need to pay loan interest)

CPF ~25%, average coupon return 2%

Overall return is not fantastic, kind of conservative capital allocation. This shall change this year when opportunities arrived due to market uncertainty.